Rental Property Tax In Spain . Web spanish tax update 2024: Web rental income earned by spanish resident entities is subject to corporate income tax (‘lmpuesto sobre sociedades’) generally. Who has to file a spanish tax return? Web for those considering renting out their spanish property, tax considerations become an integral part of the decision. You, as a landlord in spain are obliged to pay taxes per quarter if you rent your property either short. Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. Web when you rent a property, you receive an “income” which is subject of the spanish “income tax” in spain, which varies. Income from properties is categorized as investment income in spanish tax laws. Web rental income tax. In it, we look at how. Web first let’s start on actual property rental tax.

from taxadora.com

Web spanish tax update 2024: Web first let’s start on actual property rental tax. You, as a landlord in spain are obliged to pay taxes per quarter if you rent your property either short. Web when you rent a property, you receive an “income” which is subject of the spanish “income tax” in spain, which varies. Who has to file a spanish tax return? Income from properties is categorized as investment income in spanish tax laws. Web for those considering renting out their spanish property, tax considerations become an integral part of the decision. Web rental income earned by spanish resident entities is subject to corporate income tax (‘lmpuesto sobre sociedades’) generally. In it, we look at how. Web if you’re considering letting your home, read this guide to taxes on rental properties in spain.

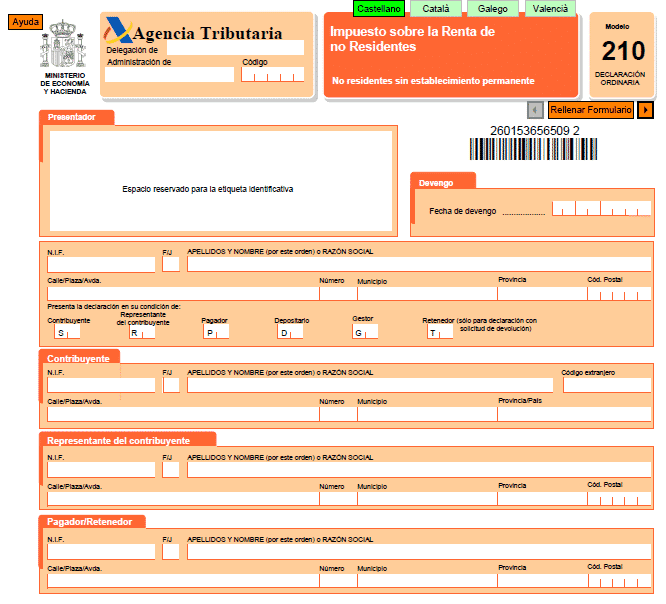

NonResident Tax Modelo 210 explained

Rental Property Tax In Spain Web spanish tax update 2024: Web first let’s start on actual property rental tax. Web for those considering renting out their spanish property, tax considerations become an integral part of the decision. Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. Web when you rent a property, you receive an “income” which is subject of the spanish “income tax” in spain, which varies. Who has to file a spanish tax return? Income from properties is categorized as investment income in spanish tax laws. Web spanish tax update 2024: Web rental income earned by spanish resident entities is subject to corporate income tax (‘lmpuesto sobre sociedades’) generally. Web rental income tax. In it, we look at how. You, as a landlord in spain are obliged to pay taxes per quarter if you rent your property either short.

From www.avail.co

Landlord Tax Documents Everything to Know for Tax Season Avail Rental Property Tax In Spain You, as a landlord in spain are obliged to pay taxes per quarter if you rent your property either short. Web for those considering renting out their spanish property, tax considerations become an integral part of the decision. Income from properties is categorized as investment income in spanish tax laws. Who has to file a spanish tax return? Web if. Rental Property Tax In Spain.

From afconsulting.es

WHAT EXPENSES CAN I DECLARE FOR THE NONRESIDENT’S 210 RENTAL TAX Rental Property Tax In Spain Income from properties is categorized as investment income in spanish tax laws. Web first let’s start on actual property rental tax. Web spanish tax update 2024: Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. In it, we look at how. Web rental income earned by spanish resident entities is subject to. Rental Property Tax In Spain.

From www.jamesedition.com

Insider’s guide to luxury property in Spain (Real Estate) Rental Property Tax In Spain Web spanish tax update 2024: In it, we look at how. Web when you rent a property, you receive an “income” which is subject of the spanish “income tax” in spain, which varies. Income from properties is categorized as investment income in spanish tax laws. Web rental income tax. Web for those considering renting out their spanish property, tax considerations. Rental Property Tax In Spain.

From www.youtube.com

How is your rental Spanish property taxes for non residents Rental Property Tax In Spain You, as a landlord in spain are obliged to pay taxes per quarter if you rent your property either short. Web first let’s start on actual property rental tax. Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. Web rental income earned by spanish resident entities is subject to corporate income tax. Rental Property Tax In Spain.

From www.ptireturns.com

All Europeans Must Know About Tax if Owning a US property Rental Property Tax In Spain Web first let’s start on actual property rental tax. Web rental income tax. Web when you rent a property, you receive an “income” which is subject of the spanish “income tax” in spain, which varies. Web spanish tax update 2024: Web rental income earned by spanish resident entities is subject to corporate income tax (‘lmpuesto sobre sociedades’) generally. You, as. Rental Property Tax In Spain.

From www.realista.com

Buying property in Spain what taxes and fees can you expect? Realista Rental Property Tax In Spain Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. Web spanish tax update 2024: Web for those considering renting out their spanish property, tax considerations become an integral part of the decision. Web rental income tax. You, as a landlord in spain are obliged to pay taxes per quarter if you rent. Rental Property Tax In Spain.

From www.spanishsolutions.net

Tax on Rental in Spain Rental Property Tax In Spain Web when you rent a property, you receive an “income” which is subject of the spanish “income tax” in spain, which varies. Who has to file a spanish tax return? You, as a landlord in spain are obliged to pay taxes per quarter if you rent your property either short. In it, we look at how. Web for those considering. Rental Property Tax In Spain.

From www.teseoestate.com

Spanish property taxes and fees Teseo Estates Rental Property Tax In Spain In it, we look at how. You, as a landlord in spain are obliged to pay taxes per quarter if you rent your property either short. Web first let’s start on actual property rental tax. Income from properties is categorized as investment income in spanish tax laws. Web when you rent a property, you receive an “income” which is subject. Rental Property Tax In Spain.

From taxadora.com

NonResident Tax Modelo 210 explained Rental Property Tax In Spain In it, we look at how. Web first let’s start on actual property rental tax. Web rental income earned by spanish resident entities is subject to corporate income tax (‘lmpuesto sobre sociedades’) generally. Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. Income from properties is categorized as investment income in spanish. Rental Property Tax In Spain.

From www.stessa.com

How Much Tax Do You Pay When You Sell a Rental Property? Rental Property Tax In Spain You, as a landlord in spain are obliged to pay taxes per quarter if you rent your property either short. Who has to file a spanish tax return? Web spanish tax update 2024: Web first let’s start on actual property rental tax. Web for those considering renting out their spanish property, tax considerations become an integral part of the decision.. Rental Property Tax In Spain.

From amigoinversor.com

Guía Completa sobre IRNR Impuesto sobre la renta de NO Residentes 2024 Rental Property Tax In Spain Web rental income earned by spanish resident entities is subject to corporate income tax (‘lmpuesto sobre sociedades’) generally. Income from properties is categorized as investment income in spanish tax laws. Web spanish tax update 2024: Web for those considering renting out their spanish property, tax considerations become an integral part of the decision. Web when you rent a property, you. Rental Property Tax In Spain.

From andaluciarentals.com

Holiday Rental Taxation Spain Rental Tax Liability Rental Property Tax In Spain Web rental income tax. Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. Income from properties is categorized as investment income in spanish tax laws. You, as a landlord in spain are obliged to pay taxes per quarter if you rent your property either short. Web rental income earned by spanish resident. Rental Property Tax In Spain.

From landlordgurus.com

Rental Property Taxes 8 Tax Tips for Landlords Landlord Gurus Rental Property Tax In Spain Who has to file a spanish tax return? Income from properties is categorized as investment income in spanish tax laws. You, as a landlord in spain are obliged to pay taxes per quarter if you rent your property either short. Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. Web first let’s. Rental Property Tax In Spain.

From propertymanagementbcn.com

Property Tax Spain (a starter guide) Rental Property Tax In Spain Web for those considering renting out their spanish property, tax considerations become an integral part of the decision. In it, we look at how. Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. Web rental income tax. Income from properties is categorized as investment income in spanish tax laws. Who has to. Rental Property Tax In Spain.

From taxadora.com

Capital gains taxes in Spain Spanish taxes made easy! Rental Property Tax In Spain Who has to file a spanish tax return? Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. In it, we look at how. Web spanish tax update 2024: Web rental income earned by spanish resident entities is subject to corporate income tax (‘lmpuesto sobre sociedades’) generally. Web for those considering renting out. Rental Property Tax In Spain.

From balcellsgroup.com

Renting in Spain Prices, Best Areas, Legal Clauses and More Rental Property Tax In Spain Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. In it, we look at how. Web for those considering renting out their spanish property, tax considerations become an integral part of the decision. Web rental income earned by spanish resident entities is subject to corporate income tax (‘lmpuesto sobre sociedades’) generally. Income. Rental Property Tax In Spain.

From alicantetoday.com

! Alicante Today Spanish Taxes Online Saves Time And Money By Paying Rental Property Tax In Spain Who has to file a spanish tax return? Web spanish tax update 2024: Web if you’re considering letting your home, read this guide to taxes on rental properties in spain. Web for those considering renting out their spanish property, tax considerations become an integral part of the decision. Web first let’s start on actual property rental tax. Web when you. Rental Property Tax In Spain.

From www.spanishsolutions.net

Rental property taxes in Spain, regulations and laws Rental Property Tax In Spain Income from properties is categorized as investment income in spanish tax laws. Web first let’s start on actual property rental tax. Who has to file a spanish tax return? Web rental income earned by spanish resident entities is subject to corporate income tax (‘lmpuesto sobre sociedades’) generally. Web spanish tax update 2024: Web if you’re considering letting your home, read. Rental Property Tax In Spain.